.png)

Is It Right Time To Sell Your House? Could Rate Hikes Lead to a 20% Drop in Home Prices?

Wednesday Mar 02nd, 2022

The Bank of Canada raised its benchmark interest rate to 0.5 percent on Wednesday, a move that's expected to be the first of a series of small rate hikes this year in an attempt to tame inflation that has risen to its highest point in decades. It's the first time the bank has raised its rate since 2018.

So Could Rate Hikes Lead to a Significant Drop in Home Prices?

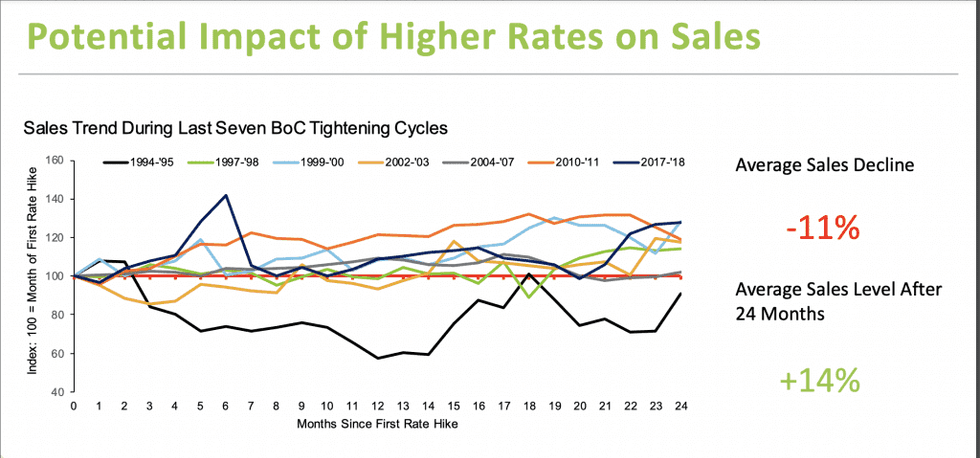

“Looking ahead, it feels like we’re at the latter stages of that phase [of speculative activity], and my expectation is that, as rates go up, assuming they do, some of that fever is going to abate a little, and you’ll see a slowdown in prices,” states Peter Routledge, Superintendent of the Office of the Superintendent of Financial Institutions (OSFI). “In some markets, where you had a really rapid increase in prices, you could see a fall of 10, 20%, even. That’ll be a return back to — I don’t want to say norm — but a return back to sanity after a sudden buildup in prices, and, by the way, we went through that in Vancouver in 2015 and 2016, and then in Toronto in 2016, 2017, and you’re talking trough-to-peak declines of 10 – 20%, so we can absorb that volatility.

His comments come in the wake of a recent Market Intelligence study from the British Columbia Real Estate Association, which predicts a 25% drop in home sales once the Bank of Canada begins its stricter monetary policy mandate.

Other industry experts, on the other hand, do not believe that the initial price impact will be as severe.

“The fact is, house prices usually don’t plummet overnight like they do in the equities market. The housing market is pretty sluggish and pretty slow to change, especially on the way down. On the way up, it can explode, but when the market’s cooling, prices tend to be pretty sticky. And that’s why I think it’s less likely that you’re going to see a 20% decline this year,” says John Pasalis, president of Realosophy Real Estate.

“We’re probably more likely to see a plateauing, perhaps some softening, if things cool in the second half of this year, a slight decline, but I don’t know if it’s going to be in the magnitude of 20%.”

Another, the more sobering argument is: how much of a price reduction would a 20% reduction actually be? According to the most recent TRREB data, average home prices in the GTA have risen 28.6% since last January, to $1,242,793. A 20% reduction would bring the price down to $994,235, putting purchasers back approximately a year in terms of affordability and keeping the most expensive end of the market – detached houses — out of reach for many.

Get a FREE Home Evaluation from our experts right now or request a FREE 30 Minutes Consultation (consider it as a nice phone conversation about real estate).

Post a comment